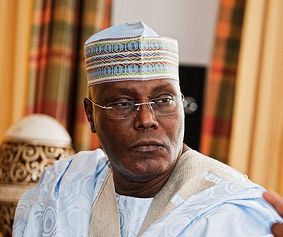

Former Vice President of Nigeria, Atiku Abubakar, has raised serious concerns over the country’s recently amended tax laws, alleging that key provisions were altered in ways that undermine fairness, federal balance, and public trust. In a strongly worded intervention, the opposition leader called for the immediate suspension of the implementation of the affected tax laws, alongside a comprehensive and independent investigation into the legislative process that produced them.

Atiku’s position has added fresh momentum to the growing national debate around tax reform, governance transparency, and the role of democratic institutions in safeguarding the interests of citizens and subnational governments.

Alleged Alterations and Legislative Integrity

According to Atiku, the tax laws passed by the National Assembly do not fully reflect the original proposals subjected to public discourse and stakeholder engagement. He alleged that critical clauses were altered at advanced stages of the legislative process, raising questions about procedural integrity, transparency, and accountability.

While stopping short of accusing specific individuals, the former vice president emphasized that any deviation between proposed bills and final legislation—without adequate disclosure or justification—poses a threat to democratic governance. He warned that such practices, if left unchecked, could erode confidence in the legislative arm of government and weaken public participation in policymaking.

Concerns Over Equity and Federal Balance

A central element of Atiku’s criticism revolves around the distributional impact of the amended tax laws. He argued that certain changes could disproportionately affect states, businesses, and vulnerable populations, particularly in a fragile economic environment marked by inflationary pressures, currency volatility, and declining purchasing power.

Atiku also expressed concern that the alleged alterations may tilt fiscal advantages toward the federal government at the expense of states and local governments, contradicting the spirit of fiscal federalism enshrined in Nigeria’s constitutional framework. He warned that any tax regime perceived as inequitable risks deepening regional disparities and fueling social discontent.

Call for Suspension and Independent Probe

In response to these concerns, Atiku called for the temporary suspension of the implementation of the affected tax laws to prevent potential economic and legal consequences. He proposed the establishment of an independent investigative panel, comprising legal experts, tax professionals, civil society representatives, and relevant stakeholders, to examine:

- The legislative history of the tax laws

- The specific provisions alleged to have been altered

- Compliance with due legislative process

- The economic and social implications of the changes

According to him, such a probe would help restore public confidence and ensure that tax reforms are rooted in fairness, transparency, and broad-based consensus.

Implications for Governance and Economic Reform

Atiku’s intervention comes at a time when the federal government is pursuing aggressive revenue mobilization strategies to address fiscal deficits and rising debt obligations. While tax reform is widely acknowledged as necessary, analysts note that process credibility is as important as policy outcomes.

Critics argue that tax laws perceived as opaque or unjust could discourage investment, weaken voluntary compliance, and intensify resistance from businesses and taxpayers already grappling with economic hardship.

Broader Political and Public Reactions

The former vice president’s comments have resonated across political, legal, and economic circles. Civil society groups and policy analysts have echoed calls for greater transparency in lawmaking, while some lawmakers have urged a review of the disputed provisions to clarify ambiguities and reassure the public.

Supporters of the reforms, however, maintain that the tax laws are essential for strengthening government revenue and funding public services, urging constructive engagement rather than outright suspension.

Conclusion

Atiku Abubakar’s call for suspension and investigation underscores a broader national concern about legislative accountability, economic justice, and democratic norms. As Nigeria continues to navigate complex fiscal reforms, the controversy highlights the need for open governance, inclusive policymaking, and respect for due process.

Whether the government heeds the call for review or proceeds with implementation, the debate has once again placed tax policy—and the integrity of the legislative process—at the center of Nigeria’s evolving democratic conversation.