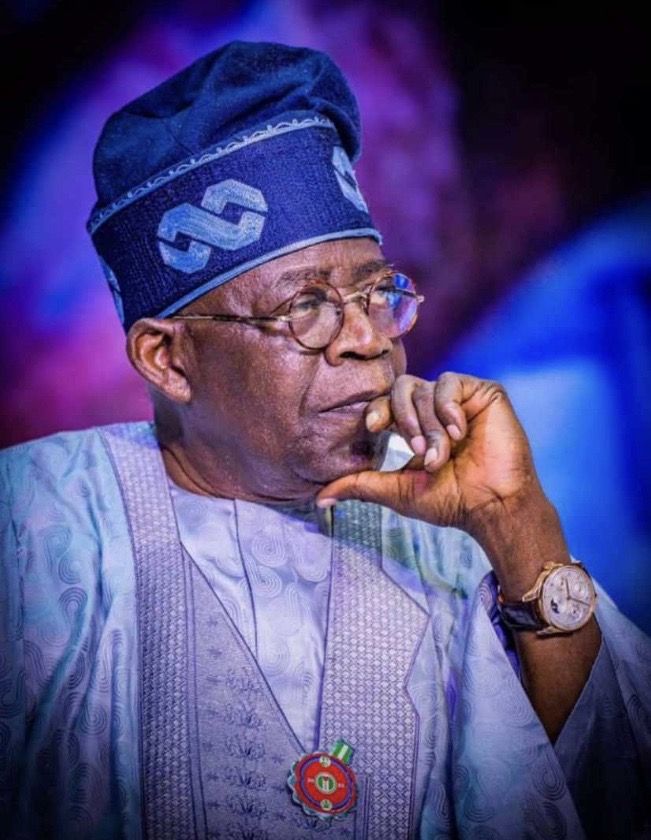

Bola Ahmed Tinubu’s administration has moved decisively into the global debt markets, officially requesting parliamentary approval for US$2.3 billion in new loans and the issuance of a US$500 million sovereign sukuk as part of a targeted funding package of about US$2.8 billion. Reuters

Read more: NIGERIA GAMING INTERNATIONAL CAPITAL: DEBUT GLOBAL SUKUK AND LOAN DRIVE SIGNAL SHIFT IN FISCAL STRATEGYThe policy pivot is anchored in the broader agenda of the so-called “Renewed Hope” reforms: by diversifying Nigeria’s sources of financing, especially into cheaper instruments such as sukuk and green bonds, the government aims to reduce its reliance on more expensive Eurobond debt and shore up its fiscal position ahead of key debt maturities. Finance Minister Wale Edun signalled that the government’s calculus is premised on improved ratings, stronger investor sentiment and better access to international capital. Reuters

Why this matters

From a governance and development perspective, Nigeria’s move into a debut global sukuk marks a strategic juncture. It signals the recognition that traditional revenue sources—oil exports, domestic taxation—remain vulnerable to global shocks and structural constraints. By tapping into Islamic finance instruments and diaspora bonds, the government is broadening its toolbox.

However, the security dimension is implicit but critical. A stable debt profile enhances state capacity to fund key security-related expenditures—personnel, equipment, intelligence and regional operations. Conversely, debt distress could constrain the state’s ability to maintain order, protect infrastructure and promote development.

Key implications and risks

- Investor confidence: Nigeria’s improved credit metrics and reform rhetoric have attracted interest—but there is no guarantee of favourable terms. Execution risk remains high: delays, weak transparency or governance shortfalls could spook markets.

- Debt sustainability: Issuing large external debt always carries risk. The efficacy of the sukuk and new loans will depend on how proceeds are used—whether for productive investment, deficit plugging or refinancing.

- Domestic trade-offs: While global financing offers relief, the pressure to deliver visible economic improvements grows. If growth fails to accelerate, public discontent may rise.

- Structural reform challenge: Borrowing is only part of the equation. To truly harness this capital, Nigeria must deepen tax collection, strengthen public investment management, maintain security for foreign-investment confidence, and ensure regulatory stability.

The road ahead

For the blog-reader concerned with the intersection of politics, development and security, Nigeria’s shift into global capitalist financing is emblematic of the evolving state-craft in Africa’s largest economy. It reflects that in the modern era, sovereignty involves not just borders but balance sheets; that development demands both ambition and discipline; and that security is sustained not only by force but by fiscal credibility.

As Nigeria pursues this strategy, the stakes are high: success could enhance state capacity, stimulate investment and improve citizen outcomes. Failure could constrain options, deepen dependency and erode the social contract.

#NigeriaPolitics #GlobalFinance #Sukuk #DebtMarkets #EconomicReform #BolaTinubu #NigeriaDevelopment #SecurityAndEconomy #InvestmentNigeria #FiscalStrategy